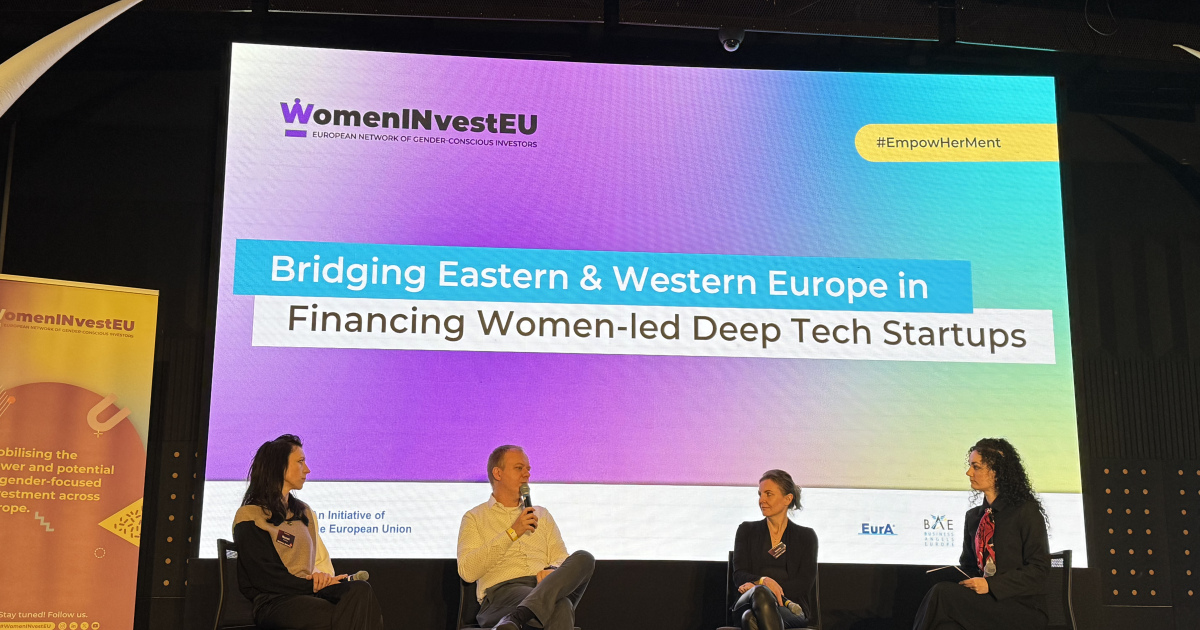

WomenINvestEU held its panel on “Bridging Eastern & Western Europe in Financing Women-led Deep Tech Startups” at the Wolves Summit, in Warsaw, on 6 May. The need for entrepreneurs to create strong, diverse networks was one of the main takeaways from the session, which tackled key aspects on how to improve funding for women-led startups both within and beyond Central Eastern Europe (CEE).

The panel sought to encourage a comprehensive discussion of the topic, featuring both experienced investors and a successful founder from the CEE.

Iwona Cymerman, Managing Partner at FundingBox Deep Tech Fund and Miroslav Beblavy, CEO of CB ESPRI brought their insights and histories as investors to the table.

Noemi Zabari spoke about her own experience as COO & Co-founder of Astroteq.ai, a Polish startup creating state-of-the art earthquake detection systems.

The discussion was moderated by Karolina Ewa Wojtas, Director of Strategic Development at Everix and Venture Partner at Eurazeo.

On the importance of building strong,

diverse networks

Throughout the panel, speakers emphasized that building a strong network is critical for women-led startups. A diverse network gives these startups access to a broader range of investors, potential team members, and clients.This requires a sustained effort from founders to increase their startup’s visibility. The panellists highlighted that success often comes to those who actively reach out to people they don’t know and don’t shy away from making themselves known.

“Approach as many people as possible that you don’t know,

even if it’s painful.” – Iwona Cymerman, Managing Partner at

FundingBox Deep Tech Fund

With access to diverse networks, women-led startups will consequently benefit from a broad range of perspectives and insights rooted in real-world experience.

However, one key piece of advice shared was the importance of discerning which feedback to listen to and act on. Not all input will be relevant or constructive, and learning to filter effectively is essential. Equally important is maintaining resilience – early rejections are common, but you should not be discouraged by them and instead, should take them as potential datapoints. Persistence, paired with thoughtful reflection, is crucial to long-term success for women-led startups.

Why we need more women in the

investment sector

Despite the crucial role that networking can play in a startup’s success, there are broader issues affecting the rate at which women-led startups access funding.On the investment side, there is a pressing need to attract more women into the sector and to encourage a more gender-conscious approach. Encouraging more women to participate as investors, even with small initial contributions, can be a powerful step. This early involvement helps build experience and, over time, cultivates role models who inspire others.

Within funds, it’s also essential to foster an inclusive environment that acknowledges and supports the experiences of women and parents. This includes ensuring that General Partners (GPs) with children, or those taking maternity or paternity leave, are not penalized. Instead, firms should implement structured planning for team transitions and adopt flexible policies to accommodate unexpected absences.

Having more women both as General Partners (GPs) and as Limited Partners (LPs) in funds will bring more diverse perspectives to the table, likely influencing the investment decisions and impacting the chances for women-led startups to access funding.

At the industry level, discussions also emphasized the critical role of private capital, particularly from pension funds, and the importance of stable regulatory frameworks to attract and retain female investors.

WomenINvestEU is proud to have organised this panel and to have counted on the insights of these members of the European Network of Gender-Conscious Investors. Find out more about our goals and membership criteria here and complete our Call for Expressions of Interest form if you would like to become a part of the network.