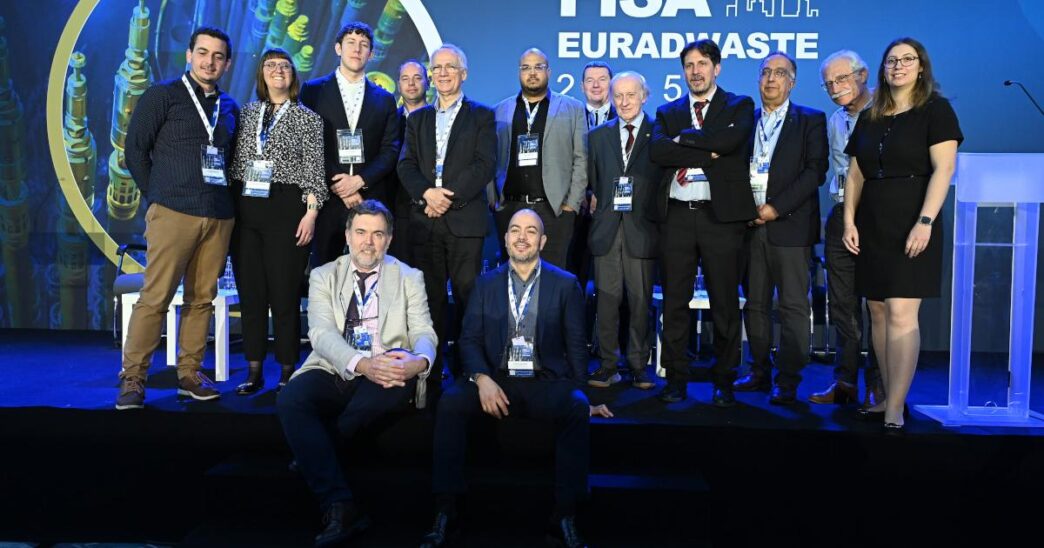

Seven breakthrough ideas awarded for contributing to safer and more sustainable nuclear technologies

News article

314 posts

We invite InvestEU’s project promoters and investors to share their views, through series of surveys, on the future outlook of markets, dependences and trends on a wide array of digital technologies critical for the EU’s competitiveness in view of investment needs for the next EC programming period.

Joining the European Alliance for Apprenticeships (EAfA) and committing to a pledge brings numerous advantages. Boost your organisation’s visibility, connect with others, and enhance the quality of your apprenticeships through valuable collaboration.

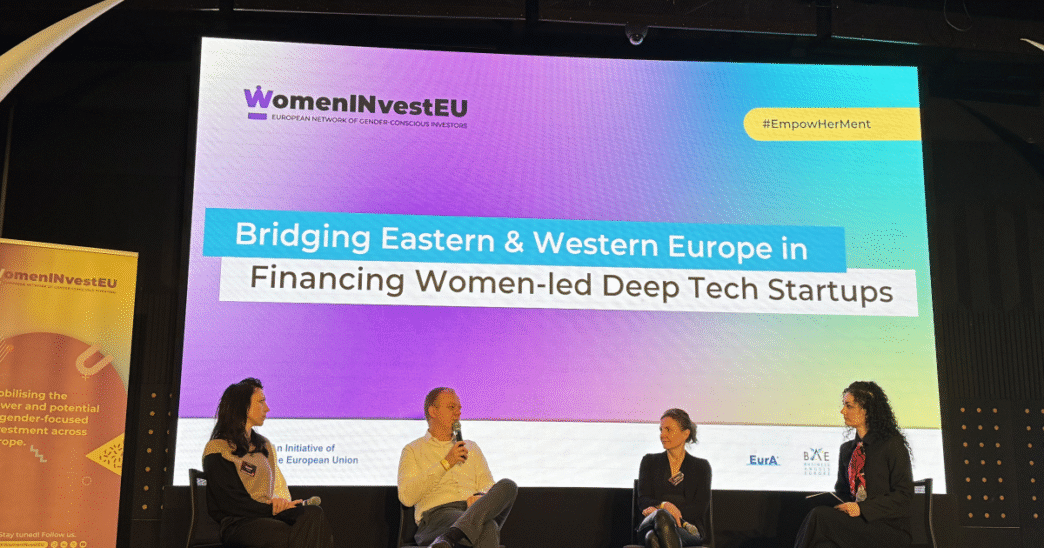

WomenINvestEU held its panel on “Bridging Eastern & Western Europe in Financing Women-led Deep Tech Startups” at the Wolves Summit, in Warsaw, on 6 May.

EBRD, EU and GCF lend US$ 5 million to Capital Leasing in Jordan. First loan to a leasing company under the Green Economy Financing Facility in Jordan. Funds to promote Jordanian private-sector investments in energy and resource-efficiency technologies.

The high-level discussion will focus on the future of Europe’s sustainable bio-based economy and will support the development of a new EU Bioeconomy Strategy, to be presented by the end of 2025.

The latest episode of PESPod – the podcast of the European Network of Public Employment Services (PES Network) – explores the impact and transformative potential of artificial intelligence (AI) on PES.

Several Latin American and Caribbean countries are grappling with humanitarian challenges, mainly due to the Venezuela crisis, natural disasters, and armed conflicts. The European Commission will provide €120 million in humanitarian aid this year to help the region’s most vulnerable.

The Commission presents its final findings on the collected proceeds for 2022 and 2023, and estimated remaining proceeds, against the backdrop of the evolution in the general situation of the fossil fuel sector.

EU finance ministers reached a significant agreement on a new approach to the Value Added Tax (VAT) focusing on e-commerce imports and the taxation of distance sales of imported goods.